Steve Forbes presides over the evolution of his flamboyant father’s empire.

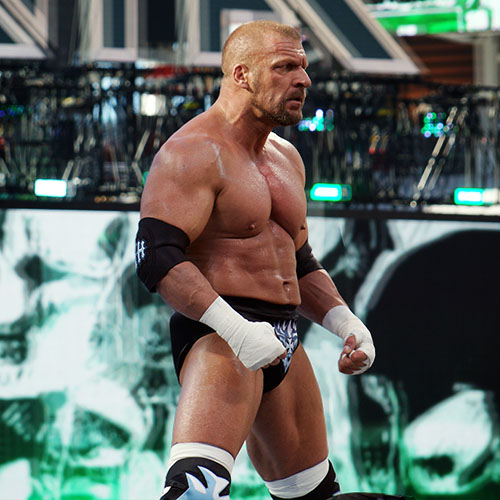

Heir Power

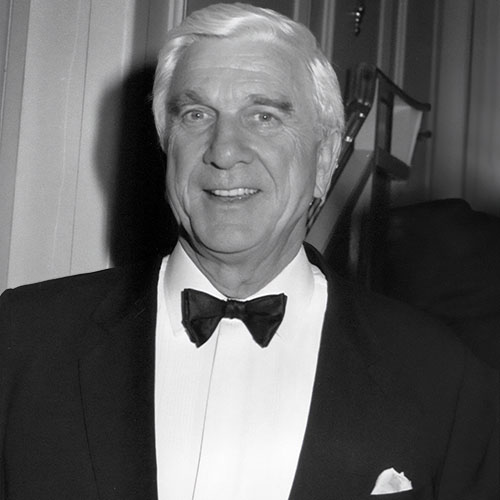

After 70-year-old publisher Malcolm Forbes died in his sleep last February, industry experts were quick to question whether the magazine that bears his name could survive without him. They certainly had a point, for Forbes was a remarkable and perhaps indispensable man.

Under his 26-year aegis Forbes became the nations brightest and most biting chronicler of corporate America’s greatest successes and most abject failures. During that same span, Forbes himself emerged as a kind of Pied Piper of capitalism. Throughout the 1980s, the press doted mightily on his almost childlike fascination for motorcycling, hot-air ballooning, and hosting lavish parties. Forbes lived very high on the hog. He maintained eight magnificent residences (including a chateau in France and a palace in Morocco) and visited them often, yet always took care of business. In the years that Malcolm ran Forbes, the fortnightly founded by his father in 1917 more than doubled its circulation (now up to nearly 800,000) and became an advertising juggernaut. Of all the magazines in America, only BusinessWeek-published twice as often as Forbes — carries more ad pages.

Forbes’s zest for life, robust good health, and elfin disposition caused his family and friends to assume he’d be around to greet the twenty-first century. That’s probably why his fatal, unforeseen heart attack so forcefully compelled all who knew him to confront their own mortality. At funeral services held at St. Bartholomew’s Church in Manhattan, Forbes’s more than 1,500 mourners included the likes of Lee la-cocca, David Rockefeller, Richard Nixon, Barbara Walters, and Elizabeth Taylor-the elegant part-time motorcycle mama who often rode pillion on one of Malcolm’s dozens of Harley-Davidsons.

The question of who would pick up the reins was never at issue. Forbes left 51 percent of the voting stock of his company to his oldest child, Malcolm Stevenson (Steve) Forbes, Jr., 43. The rest was divided among his three other sons, Robert, 42; Christopher (Kip), 41; and Timothy, 38 (all of whom work for Forbes Inc.); and daughter Moira, 35 (who doesn’t). His children knew why they weren’t given equal shares of the publishing corporation. Forbes feared that to do so might result in internecine warfare and a company without a clear-cut commander. Steve’s sister and brothers insist (and it seems genuine) that they see the wisdom of their father’s will. Steve, after all, had been groomed to take over the family business since joining the staff of Forbes in 1970.

As per his request, Forbes was cremated. But even before his ashes were interred on the Fijian isle of Laucala (which Forbes owned), New York’s culture vultures had already reached their verdict: Steve is very affable and very bright, but he’s no Malcolm Forbes.

“Of course I’ve heard that,” Steve told me a few months ago when I visited him at the Forbes Building on lower Fifth Avenue in New York. “When people compare me to my father, I like to say that he didn’t start his motorcycling until his late forties and his ballooning until his late fifties, so I’m very interested in seeing what my hormones will do. I don’t know how it’s going to turn out, but in the meantime I’m going to sit back and enjoy the show.”

Steve, low-key and a trim six foot three, works out of the second-floor office formerly occupied by his father. The room seems more like a study in a nineteenth-century men’s club than the sanctuary of a busy executive. With the exception of family photos of Steve, his wife Sabina, and their five daughters, the office remains as his father left it: plush floral-patterned carpeting, Queen Anne furniture, and walls that are alive with extraordinary paintings. When Steve’s at his desk, a 1776 Gilbert Stuart dollar bill portrait of George Washington stares down over his shoulder.

‘“If the value of Trump’s properties goes down a mere ten or 15 percent; he’ll be underwater,” said Forbes. “As our article said, this is going to be the toughest year of his life.”’

Malcolm cast a long shadow, and Steve apparently feels it would be unseemly and probably unwise to jump out of it too quickly. Twenty years ago his father told him, “I have my way of doing things, and in time, you’ll find your way of doing yours. Don’t try to be what you’re not.” Steve says, “I think he was telling me that if I attempted to do what he was doing, I wouldn’t make him happy, and I wouldn’t make myself happy. In effect he was saying, ‘It’s very hard for the acorn to grow from beneath the oak tree, because it gets overshadowed, so don’t stay near the oak tree. Go out to where the sun can shine on you.’ I plan on doing that, but I’ll leave it for others to detect the differences between my father and myself.”

The press has predicted that the biggest difference between them will turn out to be a “glamour gap.” Forbes was much beloved by the rich and famous, primarily because of his sense of humor, but also because of his sense of adventure. He was probably the most daring multimillionaire of his generation. He was the first person to cross the United States in a hot-air balloon, and when it came to motorcycles — and considering his age — Forbes was as gutsy as Evel Knievel. And almost as accident-prone. Forbes’s most serious mishap occurred in 1984, when his motorcycle spun out of control on a road in Montana’s Glacier National Park. He was thrown 100 feet along the highway and suffered a concussion, a collapsed lung, and three broken ribs. (The helmet Forbes was wearing saved his life.) Ten days later, he was back on his feet and piloting a hot-air balloon.

“I haven’t felt any great stirrings to do that sort of thing just yet, but Forbes men have a history of becoming more daring as they grow older,” Steve says. “My grandfather [B. C. Forbes] died in 1954, and the thing I most remember about him was that he grew his hair down past his shoulders — and back then, you never saw men with hair like that. Dad said his father felt that when you reach your biblically allotted three-score years and ten, you’re on your own and allowed to do anything you want. My grandfather, a Scotsman of a Victorian bent, let his hair grow long as one of his responses to that. But he never let loose the way my father always did.”

Few men ever have. As a child, Forbes collected toy boats and toy soldiers. As an adult, he spent serious money adding to those collections. Forbes also acquired far more expensive items, the most famous being his collection of jeweled imperial eggs crafted by Peter Carl Faberge for members of Czar Nicholas’s court.

“When my father took over the magazine, he decided that what Faberge was to jewelry and the arts, Forbes would be to business and journalism,” Steve remembers. “And so he tried to improve the image of the magazine by tying it into Faberge. He spent sleepless nights wondering whether he was going overboard on this kind of thing, but he finally went out and spent $50,000 on an imperial egg. He used it in advertisements for the magazine, and when another imperial egg came along he took the plunge, and he did so again and again and again.”

Forbes’s plunges became ever steeper. In 1985 he spent $1.76 million on the 11th of his 12 imperial eggs. (Forbes accumulated more of these priceless little creations than the Soviet government, which owns ten.)

“The same thing happened with my father’s collections of art and historical documents,” Steve says. “His appetites were always outrunning his bank account, but he figured you always regret what you don’t get, so get it now and worry about how you pay for it later.”

Forbes turned his collections into promotional assets by converting the lobby of the Forbes Building into a public museum to showcase his treasures. Every hobby he pursued eventually benefited the magazine. Forbes loved boating and bought his first company-owned yacht in 1955. He kept trading up, and by 1985 he had what he wanted. The fifth Highlander, a 151-foot cruiser, is ultrasleek, ultrachic, and, among other items, houses a helicopter and two speedboats. Ninety-nine percent of the yacht’s use is for entertaining statesmen and executives — which is not a deductible business expense, and wasn’t when Forbes commissioned the ship. Cruises up the Hudson River, however, proved to be a great way to make friends, generate advertising revenue, and provide Forbes writers with access to corporate C.E.O.s.

Forbes was a promotional genius, and his publicity stunts were pulled off with impeccable taste and unmistakable style. In 1982, for example, Forbes and a motorcycle gang made up of his business cronies visited China on the first of the magazine’s annual balloon-motorcycle friendship tours of various countries.

“The idea,” Steve says, “was to ride through a country on Harley-Davidsons — the bigger the better — and towards the end of each day, bring up a huge hot-air balloon shaped to have resonance in that particular nation. In Egypt the balloon was a replica of a sphinx: in Thailand, it was an elephant: in Japan, the Golden Temple of Kyoto: in Germany, Beethoven; in Turkey, a 157-foot-high likeness of Suleyman the Magnificent. These tours weren’t something a committee would dream up or even go along with. My father had a flair for publicity, and nobody held it against him because he did things that were good fun and appealed to people.”

The only negative press Forbes received during his lifetime came as a result of the 70th birthday party he threw for himself and 800 guests in Tangier in 1989. The three-day bash cost a reported $2 million and became a minor cause of controversy. Ted Koppel on “Nightline,” Sam Donaldson on “PrimeTime Live,” and scores of other broadcasters and newspaper reporters criticized Forbes on grounds of wretched excess.

“We concluded that my father probably picked the wrong day to be born — in the dog days of August, there wasn’t much else to write about, so his birthday party received extraordinary play,” Steve tells me. “When he was questioned about it, my father made the point that $2 million wasn’t going to solve any of our social problems, and that he gave away much more than that each year. But he could only give money away if he had a successful business — and functions like his birthday party helped make his business successful. Most people said fine, that’s legitimate.”

Opulent parties, the friendship tours, the cruises up the Hudson with potential advertisers — they’ve become institutions at Forbes and will continue. As for new promotions, Steve still isn’t ready to talk about what he’ll do, although he concedes that as the magazine’s chief honcho, he’s expected to maintain a high profile.

“Right now my reaction to all that is probably the publishing equivalent of George Bush talking about ‘the vision thing’ — I haven’t thought about it yet,” he readily admits. “But I think the spirit of the approach will be my father’s. I’ll try to do things in a light, fun way.”

If all this talk about publicity and promotion seems like fluff, it isn’t. Publishing insiders estimate that Malcolm was personally responsible for nailing down ten percent of the magazine’s advertising revenues, which in 1989 added up to $160 million. Steve’s not yet a $16- million-a-year supersalesman, but at the same age, neither was Malcolm.

If the contrasts between father and son seem obvious, the same can be said for the similarities. Both graduated from Princeton, and both started publications while at the university. Malcolm’s was Nassau Sovereign, an on-cam pus newsmagazine. Steve cofounded Business Today, a national quarterly distributed to 50,000 students.

“The timing was dreadful,” Steve recalls. “We started it up in the spring of 1968, when college campuses were being turned upside down because of the war in Vietnam. The magazine’s purpose was to provide a balanced perspective on the business world, which no one wanted to hear then.” By the time brother Kip arrived at Princeton and was asked by Steve to take over advertising sales (a job he now handles for Forbes), the magazine had found its audience. Steve handed over the magazine to underclassmen when he graduated, but continues to follow its progress. Now in its 23rd year of publication — with a circulation that’s grown to 200,000 — Business Today is the most successful periodical ever published by students for students.

Another similarity between father and son is their commitment to print journalism. Unlike Rupert Murdoch, Time Warner, Dow Jones, and other media winners, Forbes Inc. has no interest in television, movies, or electronic-information services. The firm’s newest ventures — all initiated by Forbes shortly before his death — are modest by any measure and continue the family tradition (think Scotsmen now) of never going into debt.

FYI, a quarterly devoted to executive lifestyles (and run by brother Bobby), debuted in September 1989. The company’s other start-up, egg, chronicles the latest new-wave goings-on in New York and Los Angeles. Tim, the last of the brothers to sign on, is in charge of both egg and American Heritage, which Forbes purchased in 1986 for a reported $10 million. The first issue of Forbes von Burda, the magazine’s German edition, appeared last March. A Chinese edition of Forbes will soon be published in the Orient.

In his capacity as corporate president, Steve oversees all of the above, plus the family’s string of a dozen weekly newspapers in New Jersey. His top priority, however, is his job as editor in chief of Forbes. During one of my visits to his office, Steve stared balefully at the mountain of paper on his desk.

“This is similar to when you first go away to college,” he said. “There’s no way you can possibly read all the material you’re given on an assignment — if you tried, you’d be carried out on a stretcher. So you learn how to scan and how to measure your time. With a business you do the same thing, although with this business the sheer volume of what crosses my desk makes me appreciate my father even more. He never let himself get bogged down by the ‘in’ box; he set the agenda. There aren’t enough hours in the day to do everything the way I’d like to, so I’ve had to adjust and learn how to cope with it.”

Steve’s coping just fine these days, though he’s found the going hectic. Since taking over for his father, he’s spent at least one week a month traveling on behalf of the magazine, usually to meet with advertisers. He’s often so tightly scheduled that the best time to talk with him is when he’s flying somewhere. Rather than have me become a semipermanent fixture hovering outside his office, Steve invited me to accompany him on a trip to California.

At the end of what had been a long and hectic day for Steve, he and I boarded one of his company’s helicopters at Manhattan’s 30th Street heliport. When we arrived at Newark Airport, we landed less than 100 feet away from the firm’s Boeing 727. Forbes had had the plane painted “money-green and gold.” Taking a little dig at Marxist rhetoric, Malcolm had dubbed it the Capitalist Tool, which is proudly spelled out on the tail of the aircraft.

We took off at about 10 P.M. Forbes immediately began reading through the ever-present stack of reports he carries in a battered leather briefcase that dates back to his college days. After about two hours, he told me he was too bushed to talk, and went into the bedroom up front and crashed for the rest of the flight. I was now the only passenger in the main cabin, which is laid out like a living room and filled with cream-colored leather easy chairs and sofas. It’s a great way to travel, but no matter how comfortable you make it, a flight from New Jersey to California is still a six- or seven-hour ride, depending on head winds, which were heavy that night. We got to Los Angeles a little after 2 A.M. A limousine was waiting and whisked us off to a nearby hotel.

At 8:45 Steve met with his advertising staff, and later lunched at a Japanese restaurant with the American head of lnfiniti automobiles. Then we reboarded the Capitalist Tool and flew to San Francisco, where Forbes would host an early-evening cocktail party for its advertisers.

On the flight up the coast, Steve told me what he considers to be his magazine’s greatest strength.

“Our bread and butter is the company story, and we keep it conversational rather than write in the stilted, institutional prose of the State Department,” he noted. “My grandfather said you can learn more about a company and get a better feel for its prospects by looking at the C.E.O. than at the balance sheet. That’s been our credo, and I think it’s true. If management isn’t on the ball, any company is going to come a cropper, even General Motors. G.M. went from having almost 60 percent of the market down to below 30 percent, and it’s struggling to stop the slide. Contrary to most publications, we won’t do a story unless we have a definite judgment to make or a conclusion to reach. As someone once put it, each of our stories is a small morality play with a lesson to be learned.”

Years ago his father told him that in life, the only constant is change. Steve believed it then, believes it now, and has already begun modifying the magazine’s editorial focus. In the future Forbes will run more articles about international trade and government rulings that affect the way corporations do business. Steve has stated numerous times that under his stewardship, Forbes will undergo an evolution rather than a revolution. When I asked him if the evolution had begun, he laughed.

“It’s probably too soon to discern a trend,” he said, “but I think the issue with our article on Donald Trump was very focused and very good. We got the Rosetta stone on that one, after which everyone else jumped on the story.”

Published last spring, the Forbes cover story on Trump (“How Much Is Donald Really Worth Now?”) claimed that the hard-driving real estate mogul was down to his last $500 million, a precipitous drop from the $1.7 billion the magazine reported he was worth in 1989. Trump angrily dismissed Forbes’s findings, but soon after the article appeared, he was forced to embark on the first of a series of mad scrambles to avoid bankruptcy. Trump blames the magazine for a lot of his problems.

“That’s his version: We started it all,” says Steve. “But Donald’s always been very aggressive in defending himself. He’s vulnerable now and feels we did him a bad turn, and I’m sure he’s convinced we did it for reasons that had nothing to do with the article. To be fair to the guy, he had some real successes — like the Trump Tower and the Grand Hyatt Hotel — in the 1970s and 1980s. Maybe he oversold what he did, but he did it. His Atlantic City casino operations (the Trump Plaza and Trump Castle] were fine until he got sucked into building the Taj Mahal. Trump’s leap into the third casino and his purchases of the Plaza Hotel in New York and the Trump Shuttle were done with very little equity, and he may have bitten off more than he can comfortably chew.”

By way of explanation, Steve pointed out that Trump borrowed $400 million to purchase the Plaza Hotel, $360 million to buy the Trump Shuttle (from Eastern Airlines), and somewhere in the neighborhood of $850 million to build the Taj Mahal. Add what he owes on the Trump Plaza, Trump Castle, and a dozen other properties, and the Donald’s overall debts amount to a staggering $3.2 billion.

“Some people felt we were being too generous by valuing his assets at $3.7 billion, but the point is this: If you have a net surplus of $500 million against $3.2 billion in debt, you’re left with very little margin for error,” Steve says. “When people hear that Trump’s net worth is $500 million, they think of it as cash in the bank, but it’s not. It’s assets, and assets change in value. We saw it happen with oil in the mideighties, and now we’re seeing it happen with a vengeance in real estate. If the value of Trump’s properties goes down a mere ten or 15 percent, he’ll be underwater. As our article said, this is going to be the toughest year of his life.”

In September 1990 Forbes again made news when it ran a harshly critical cover story on Ralph Nader that depicted the nation’s leading consumer advocate as an accumulative wheeler-dealer rather than the ascetic he’s always claimed to be. Forbes estimated that Nader controls — to varying degrees — 29 organizations with combined revenues of at least $75 million and assets of at least $24 million. Perhaps the most serious charge Forbes leveled was that Nader is in bed with the nation’s trial lawyers and has actively lobbied against tort reform — which might prevent lawyers from grabbing anywhere from one-third to one-half of the judgments awarded to their clients. (Nader responded in a letter, subsequently published in Forbes, that the article contained numerous inaccuracies.)

“I think the Nader story was an example of our willingness to go against the grain,” Steve observes. “Here’s a man who’s rarely, if ever, been criticized about his own operations. We didn’t argue with his stance on issues — there’s been plenty of criticism about that — but we did feel that while Nader condemns everyone for lack of disclosure, he is probably more close-mouthed than the most antipublic plutocrat around today. Nader has extensive interests and lives a lifestyle he doesn’t like to discuss. No one would begrudge him the right to live in a town house that’s worth $1.5 million, but why does he pretend he doesn’t? He’s just not what he’s portrayed himself to be, and he’s been as tight-lipped and uptight about it as you’d expect a corporate chieftain to be.”

“I came to the attention of top management at a fairly young age,” said Steve. “As my father liked to say, ‘There’s nothing wrong with nepotism as long as you keep it in the family.’”

A few hours after the Capitalist Tool touched down in San Francisco, I accompanied Steve to the Bankers Club, located on the 52nd floor of the Bank of America World Headquarters Building. About three dozen high-powered Bay Area executives were on hand to hear Steve deliver a short talk about America’s economy, after which they’d be pitched to support a Forbes ad supplement devoted to California commerce. Also on hand was Governor George Deukmejian, who made some introductory remarks about his state’s favorable business climate. (Forbes has enormous clout with politicians.)

Steve then took the podium. I’d seen him present a commencement address at New Jersey’s Raritan Valley Community College, which is only a short drive away from the pheasant farm where he and his family live. That night he had adroitly tried on his father’s approach to public speaking, which was to kid the underlying reason for his success. (“I came to the attention of the top management of Forbes at a fairly young age,” Steve told the graduating class. “As my father liked to say, ‘There’s nothing wrong with nepotism as long as you keep it in the family.’”)

On this occasion, however, Steve mowed down his audience with a 15-minute fusillade of economic facts, figures, and formulations. U.S. business and labor would both benefit from a cut in the capital-gains tax, which would also result in a lower annual budget deficit; the U.S. trade deficit in and of itself is meaningless — Brazil, Mexico, and Argentina have trade surpluses, and they’re all broke; the Federal Reserve System is hurting everyone by keeping interest rates artificially high; at the beginning of the 1980s, we’d invested a little over $500 billion in our economy, but by the end of the decade that figure had passed $1 trillion. Steve finished up by talking in numbers; he might as well have been speaking in tongues. His father once claimed that Steve’s “facility for retaining information but not being swamped by it is computerlike.” That didn’t hold true for the ad executives. They followed his rapid-fire financial assessments about as closely as they’d follow a lecture on bowing techniques by cellist Yo-Yo Ma.

The next morning we flew back to Los Angeles, where Steve would speak to a similar audience that evening at the Four Seasons Hotel. In San Francisco he’d sounded more like a professor than a publisher, which was understandable, if not effective. Despite his age, Steve is one of the nation’s leading economic analysts, and has the bona tides to prove it. For the past 45 years, USX (which until recently was U.S. Steel) has annually presented its prestigious Crystal Owl award to the writer who makes the most accurate economic forecast of the coming year. Steve Forbes is the only person to win the Crystal Owl more than once.

He’s won it four times.

Steve writes a two-page compendium of editorial reflections (“Fact and Comment”) in every issue of Forbes, and although his subject matter is generally quite serious, he occasionally airs his sense of humor. “Don’t Tamper With Pampers” was a high-spirited defense of disposable diapers against environmentalists who “are like Cotton Mather and central bankers — they don’t want the rest of us enjoying ourselves.” In “All Hail George Bush,” Steve claimed that the President had “guaranteed himself a high place in history” by denouncing broccoli. This tongue-in-cheek polemic charged that “broccoli encourages bad eating habits. What normal youngster, after having to swallow a plateful of this alleged food, wouldn’t flee to candy bars, cookies, Cokes, ice cream, or even pork rinds?”

Usually, however, Steve’s deliberations are devoted to weightier topics. In May 1990 he called Iraq’s Saddam Hussein a “bloodthirsty dictator” who was developing chemical-warfare missiles for use against Israel, as well as going all out to develop nuclear weapons. “If this terrorist’s potential to black-mail other countries is to be curbed, now is the time to do it,” he wrote.

At the start of October, two months after Iraq invaded and annexed Kuwait, Steve remained resolute in his condemnation of Hussein. And highly pessimistic about bringing him under heel via peaceful means. “Obviously, the situation will change by the time your story is published, but I think it’s going to come to blows,” he told me. “While we’ll pay a short-term price, regrettably, in blood and treasure, there will be long-term benefits. Because of the end of the Cold War, we’re in a situation very much like the one we were in at the end of World War II: We’re setting the rules for a new world order. We’re going to have a much better future if we agree that aggressors are not going to get away with being aggressive, and that we’re not going to sit back and let the bad guys develop poison chemicals, nuclear weapons, and ballistic missiles that can reach the United States. Just because the Kremlin is having problems doesn’t mean that the world is safe and secure.”

Steve felt that a compromise with Iraq was possible but not advisable. “Any agreement with Hussein will be worse than no agreement at all,” he warned. “In other words, he’s not going to voluntarily withdraw from Kuwait, scale down his army, destroy his stockpile of poison chemicals, stop developing ballistic missiles, and stop developing nuclear weapons. By drawing the line on Saddam Hussein right now — by not allowing him to get away with a facesaver on Kuwait — we will save ourselves infinitely more grief and trouble later on.”

Leaving aside the subjects of oil and Iraqi aggression, Steve is decidedly bullish on the 1990s. “Look at where we are today and where we were ten years ago,” he told me on the flight down to Los Angeles. “Interest rates are lower, inflation is lower, and taxes are lower. There are more jobs, and we’ll continue to benefit from having started the technology revolution — the microchip has expanded the reach of the human brain the way machines extended the use of human muscle 150 years ago. If we avoid doing something stupid — such as getting into a trade war like we did in the early thirties or substantially raising taxes like we did in the seventies — there’s no reason why the nineties shouldn’t· be a very good decade.”

Many economists aren’t nearly as optimistic about the nineties, mostly because the government has never met a budget deficit it didn’t like. They warn that our overspending will result in an inevitable fiscal crisis, but Steve disagrees.

“My feeling is that the real problem with the deficit is what people will do in the name of fighting it — i.e., putting in big tax increases or cutting too much on some outlays for government agencies,” he says. “The budget deficit as a percentage of our gross national product has fallen by half over the last four years. And as a percentage of G.N.P., our overall government deficit — state, local, and federal — is less than that of most countries. So to me, the question becomes whether it’s better to encourage growth in the economy — which can mean more revenue streams in the future — or throttle the economy down for a temporarily balanced budget. I take the long view, Jack Kemp’s view, on this: We shouldn’t worship at the altar of a balanced budget. Our policy should be designed to let the economy grow, rather than cause it to contract.”

“The real peace dividend will be the reallocation of brains and private capital from defense-oriented purposes to more productive civilian uses.”

Steve presumes that the end of the Cold War is a virtual guarantee of lower budget deficits, chiefly because the United States will be spending less each year on defense — one-third less, he believes, by the turn of the century. The conventional wisdom is that our savings on military outlays will result in a so-called “peace dividend.”

“There will be a peace dividend, but it won’t be money; you’ll never see that.” Steve says. He anticipates that defense savings will go toward reducing the deficit and/or helping to pay for the savings-and-loan debacle, or anything else Congress feels like using it for.

“The real peace dividend will be the reallocation of brains and private capital from defense-oriented purposes to more productive civilian uses,” he adds. “The defense wind-down is going to be quite painful, but once it takes place, as it will, the nation’s brainpower — in science, management, labor, and research — will be diverted to the production of consumer goods and services. That’s going to be enormously beneficial to our economic health.”

The Forbes reception at the Four Seasons Hotel was a replay of the San Francisco cocktail party with just a couple of variations. Only about two dozen advertising people showed up (not many more were invited), and instead of the governor, the director of California’s Department of Commerce, Kenneth Gibson, handled upbeat opening remarks about the state’s economy.

Steve’s speech contained much of the same information he’d conveyed in San Francisco, but his delivery was vastly different. A quick study, he wasn’t about to befuddle advertisers two nights in a row. At the start of his talk, Steve made a prediction. “Before the end of the year, you’re going to see a rally in the stock market,” he declared. “That was sort of guaranteed in January by what happened in the Super Bowl. Some of you know that whenever an old N.F.L. team wins the Super Bowl, the stock market goes up. I don’t know if there are any Denver Bronco fans in this room — I doubt it — but if there are, just know that your team went down in the nation’s service.”

He was equally facile on the U.S. trade deficit. “Japan ran up big trade deficits in the fifties and sixties, and you should read what American economists wrote about the Japanese economy back then,” he said. “They didn’t write, ‘Here comes a country that’s going to challenge and humble much of American industry.’ Instead, they wrote that the Japanese economy was a hopeless basket case. As you know, the Japanese are not a foolish people. They didn’t bother translating that stuff into Japanese — and look what their ignorance did to them.”

Steve was kidding on the square, and his observations were on the money. The small gathering was surprised and delighted. When he finished, he received much more than a perfunctory round of applause. Afterward he was all smiles. So were his staff guys, who’d often seen Steve’s father work a room with the same kind of wit. timing, and insight.

A couple of hours later, Steve headed back to Newark on the Capitalist Tool; I remained in L.A. to finish researching a book I was working on. Before we parted company, I asked Steve if it was true — as his ad staff had claimed — that one out of every three Forbes subscribers is a millionaire.

“Yes,” he said, “but we don’t think of Forbes as a magazine for millionaires. Our thesis is that normal people who read the magazine become successful — that’s how our subscribers got to be millionaires.”

Steve had a mischievous, Malcolm-like twinkle in his eye.

The old man would have loved it.

By the way, ten years prior to this article Forbes had even noticed our founder Bob Guccione. As it turned out, Bob was a lot richer in the 1980s than he ended up being at the end.